Call Monday-Friday 9am - 6pm Closed Saturday & Sunday

Leasing vs Buying a Car: Weighing the Pros and Cons

Are you looking to get a new car or van? In today's market, UK consumers have more options than ever regarding securing a new vehicle. In these choices, leasing and buying are the two most popular methods.

Which is the right option for you?

Here look to provide you with a comprehensive understanding of both leasing and buying.

A brief explanation of leasing and buying

Leasing a car involves entering into a contractual agreement with a finance company. This also allows you to drive a vehicle for a fixed period and with maximum miles permitted.

You typically have to return the car at the end of the lease. A key feature is that you do not have the option to purchase it. You can then get a fresh lease agreement for a new, replacement vehicle.

Leasing is often compared to renting. You are only paying for the use of the car rather than owning it.

On the other hand, purchasing a car means owning the vehicle. This may be either by purchasing it outright, with cash, or by financing the cost through a loan or hire purchase agreement.

In the case of financing, you make monthly repayments over a set period until the agreement for the car is paid off. Once this happens, the vehicle is yours to keep, sell, or trade-in as you see fit.

Leasing vs buying a car - the pros and cons

We will examine the advantages and disadvantages of leasing and purchasing a car. We will explore factors such as cost, flexibility, and long-term value.

Additionally, we will cover essential aspects related to insuring a vehicle and discuss the benefits of various supplementary insurance products.

Considering all these factors, you will be better equipped to weigh the pros and cons of leasing vs. buying.

What is car leasing?

Key features of car leasing

Car leasing is a long-term rental agreement. It usually is between an individual or business and a finance or leasing company.

The lessee, or person leasing the vehicle, pays a fixed monthly rental in exchange for using the car for a set duration and agreed-upon mileage limit.

The leasing company retains ownership of the vehicle throughout the leasing contract.

At the end of the term, the lessee can only return the lease car but not purchase it.

Often lease deals are arranged on a brand-new car, but not in all cases.

Types of car leasing

1. Business Contract Hire (BCH)

Business Contract Hire (BCH) is a type of vehicle leasing specifically designed for businesses. It allows companies to provide vehicles for their employees without the financial burden of purchasing them outright.

A BCH lease deal generally includes maintenance packages, and the lease payments can be offset against taxable profits, offering potential tax advantages for businesses.

2. Personal Contract Hire (PCH)

Personal Contract Hire (PCH) is a widespread car leasing agreement for private individuals. Like BCH, PCH allows you to drive a new vehicle for a fixed term without the responsibility of ownership.

PCH agreements often come with lower monthly rental payments than other finance options, making it an attractive choice for drivers seeking to upgrade their cars more frequently.

With most leases, there will be an advanced rental to pay upfront.

How leasing works

Leasing a car involves a simple, straightforward process:

1. Choose your desired vehicle and lease term, typically ranging from 12 to 48 months.

2. Determine your annual mileage limit, impacting the monthly lease cost.

3. Agree on an initial payment, usually equivalent to a multiple of the monthly lease fee.

4. Make lease payments throughout the agreement term, covering depreciation and financing fees.

5. At the end of the lease, you usually return the vehicle to the leasing company. You may face additional charges if you have exceeded the mileage limit or the car shows excessive wear and tear.

6. Normally, you will have no option to purchase the vehicle.

7. You are free to enter a new lease for another car.

What is car buying?

Vehicle buying means acquiring ownership of a vehicle, either by paying the total price upfront or financing the cost through a loan or other financial arrangement.

Buying a vehicle allows you to use the car without restrictions. Once any outstanding finance has been settled, you can keep, sell, or trade-in the vehicle as you wish.

In other words, the vehicle is your asset.

How to buy a car

1. Cash purchase

A cash purchase involves paying the full vehicle cost upfront without financing.

This method is the most straightforward way to buy a car and often allows for a bit of negotiation on the price.

Additionally, cash buyers don't have to worry about interest charges. Buying outright is, arguably, the most cost-effective option in the long run.

2. Hire purchase (HP)

Hire purchase (HP) is a type of car finance that involves paying a deposit, followed by fixed monthly payments over a set term, typically ranging from 12 to 60 months.

The vehicle serves as security for the loan, and ownership is only transferred to the buyer once the final payment has been made.

HP agreements usually require a higher deposit than other finance options, but interest rates can be competitive.

This can be particularly true with manufacturers-provided finance, where interest rates can be subsidised to make taking finance more attractive.

3. Personal Contract Purchase (PCP)

Personal Contract Purchase (PCP) is a flexible car finance option combining leasing and buying elements.

It requires an initial deposit, followed by lower monthly payments than HP, as you only finance the car's depreciation.

At the end of the contract, you can choose to return the vehicle, purchase it by paying a predetermined "balloon payment," or use any equity built up as a deposit for a new car.

4. Personal loan

A personal loan is a loan from a bank, building society, or another lender. This loan can be used to buy a car. What makes it different from HP or PCP is that it is not secured against the car.

In effect, you own the car 100% from day one.

This option allows you to spread the cost of the vehicle over an agreed term with a set monthly payment and a fixed interest rate.

As the personal loan is unsecured, you own the car outright, making it easier to sell or trade in at any time.

How buying works

1. Choose your desired vehicle and negotiate the best price possible.

2. Determine your preferred method of payment: cash, hire purchase, personal contract purchase, or personal loan.

3. If financing the purchase, provide a deposit (if required) and agree on the term, monthly payments, and interest rate with the finance provider.

4. Complete the required paperwork.

5. Make monthly repayments (if applicable) until the finance agreement is settled when you'll own the car outright.

6. Have the option to use, modify, sell, or trade in the vehicle as you see fit.

Pros of car leasing

Lower monthly payments

One of the primary advantages of leasing a new car is the lower monthly payments compared to when you buy a vehicle through HP or PCP.

Since you're only financing the vehicle's depreciation during the lease term, the monthly costs are typically more affordable.

Lower monthly payments allow many drivers to enjoy a better vehicle than they might otherwise be able to afford.

Smaller deposit

Leasing a car generally requires a smaller initial payment compared to other financing options, as the deposit is often calculated as a multiple of the monthly rental.

This may be known as the advanced or initial rental payment.

This lower upfront cost can be an advantage for those with a small sum of money available for a deposit.

Access to newer models

Leasing enables drivers to upgrade their vehicles regularly, typically every two to four years, depending on the lease term.

This frequent turnover allows you to enjoy the latest technology, safety features, and fuel efficiency improvements, contributing to a more enjoyable and cost-effective driving experience.

No long-term commitment

With a lease, you aren't tied to the vehicle in the long term.

Once the contract ends, you can return the car and look at a new lease for a replacement car. This helps you to avoid concerns about depreciation, selling, or trading in the vehicle.

This flexibility can be especially appealing to those who enjoy driving a variety of cars or who anticipate changes in their driving needs.

Maintenance and warranty benefits

Many leasing contracts include maintenance packages covering routine servicing and reducing out-of-pocket expenses for vehicle upkeep.

Additionally, as leased vehicles are typically new or nearly new, they're often protected by the manufacturer's warranty for most of the lease term.

This coverage can provide peace of mind and help minimise unexpected repair costs.

Cons of car leasing .png)

Limited mileage allowance

Leasing contracts come with a maximum annual mileage limit. If exceeded, this can result in substantial charges at the end of the lease.

For drivers who cover long distances or have unpredictable driving patterns, this limitation can be a significant drawback and lead to additional costs.

Potential charges for wear and tear

When returning a leased vehicle, you may face charges for excessive wear and tear or damage beyond what's considered "fair wear and tear."

These charges can be substantial and might add to the overall cost of leasing.

To avoid these additional costs, it's essential to take good care of the vehicle and address any damage promptly.

No ownership of the vehicle

One of the most significant disadvantages of leasing is that you never own the vehicle outright.

For some drivers, the lack of ownership can be a concern. They're paying for the use of a car without building equity or enjoying the long-term benefits of owning a vehicle.

Difficulty in terminating the contract early

Leasing contracts can be difficult and costly to terminate before the agreed-upon term ends. Early termination fees can be substantial, and the lessee may also be required to cover the remaining depreciation costs.

This inflexibility can be a disadvantage for those who experience a change in their financial circumstances or driving needs during the lease term.

Possible higher insurance costs

Leasing a car may result in higher insurance premiums, as leased vehicles often require comprehensive coverage, and the leasing company may set specific coverage requirements. Additionally, some insurance providers view

leased vehicles as higher risk due to their perceived higher replacement value. As a result, lease drivers may face higher insurance costs than those who own their cars outright.

Pros of car buying

Ownership of the vehicle

One of the most significant advantages of purchasing a car is that it is your asset.

Once you've paid off any outstanding finance, the vehicle is yours to keep, sell, or trade in as you see fit.

No mileage restrictions

If you are a heavy car user and cover a high mileage, owning the car means you are not penalised for doing more miles.

Ability to modify or customise the car

Owning a car allows you to modify or customise your tastes or driving preferences.

Whether upgrading the ICE` system, changing the wheels, or having a custom paint job, owning a car allows you to make the vehicle uniquely yours.

Potential to build equity

When you buy a car, particularly with cash or a loan, you have the potential to build equity over time. This happens as you make payments and reduce the amount you owe.

Equity grows when the vehicle's value depreciates slower than the loan balance.

This equity can be used as a down payment on your next vehicle or as a financial asset when needed.

Easier to sell or trade-in

Owning a car provides flexibility regarding selling or trading in the vehicle.

You can sell the car privately or trade it in at a dealership.

This flexibility can be particularly beneficial if your needs or preferences change and you want to switch to a different car without being restricted by a lease agreement.

Cons of car buying

Higher monthly payments

One of the primary drawbacks of car ownership, especially when financing, is the higher monthly cost compared to leasing. Since you're financing the entire vehicle cost, the monthly payments are generally higher, which can strain your budget or limit your options when selecting a car.

Larger deposit

Buying a car often requires a larger initial payment or deposit, particularly when financing through hire purchase or personal contract purchase agreements. This higher upfront cost can be a barrier for those without significant savings, making leasing a more attractive option in such cases.

Depreciation

When you own a car, you are exposed to the risk of depreciation.

Most vehicles lose the most significant part of their value within the first few years from being new. If you sell or trade in the car, this can be a considerable financial blow.

On the other hand, leasing protects you from the full impact of depreciation, as the vehicle is not yours to lose money on.

Maintenance and repair costs

If you buy a car, you're responsible for all maintenance and repair costs, which can be expensive over time.

While leased vehicles often include maintenance packages and are covered by manufacturer warranties, car owners must budget for these expenses, adding to the overall cost of ownership.

Obsolescence risk

When you buy a car, you risk your vehicle becoming outdated as new models with improved technology, safety features, and fuel efficiency enter the market.

This obsolescence risk can negatively impact the resale value of your car and lead to higher long-term ownership costs.

In contrast, a short leasing cycle allows you to access newer models, reducing the impact of obsolescence.

Insuring the vehicle

Importance of insurance in the UK

Car insurance is a legal requirement in the UK, ensuring drivers have financial protection in accidents, theft, or damage.

Whether you're leasing or buying a car, having the appropriate level of insurance coverage is essential for legal compliance, safeguarding your financial well-being, and providing peace of mind while on the road.

Being correctly insured could also be a requirement of any lease arrangement you have in place.

Types of insurance

Third-party only

Third-party-only insurance is the minimum level of coverage required by law in the UK. It covers any damage or injury you cause to other people, their vehicles, or their property in an accident. However, it does not cover any damage to your car or injuries you sustain.

Third-party, fire and theft

Third-party, fire and theft insurance provides the same level of coverage as third-party-only insurance but also covers your vehicle in the event of a fire or theft. This type of insurance is a more comprehensive option, providing additional protection for your car without the higher cost of a fully comprehensive policy.

Comprehensive

Comprehensive insurance offers the highest level of protection, covering not only third-party liabilities but also damage to your vehicle and personal injuries, regardless of who is at fault in an accident.

This type of insurance often includes additional benefits, such as windscreen repair, breakdown cover, and courtesy car provision, making it the most popular choice among UK drivers.

Factors affecting insurance premiums

Several factors can influence the cost of your car insurance, including:

1. Vehicle make and model: High-performance or luxury cars are typically more expensive to insure due to their higher repair costs and increased theft risk.

2. Driver's age and experience: Younger and less experienced drivers often face higher insurance premiums, as they're statistically more likely to be involved in accidents.

3. Location: Living in an area with a high crime rate or heavy traffic can increase insurance costs.

4. Annual mileage: Drivers who cover longer distances are generally considered a higher risk, resulting in higher premiums.

5. Driving history: A clean driving record with no accidents or traffic violations can help lower your insurance costs.

When insuring a leased or purchased vehicle, it's essential to shop around and compare quotes from multiple insurance providers to find the best coverage and price for your needs.

Additional insurance products

Gap insurance

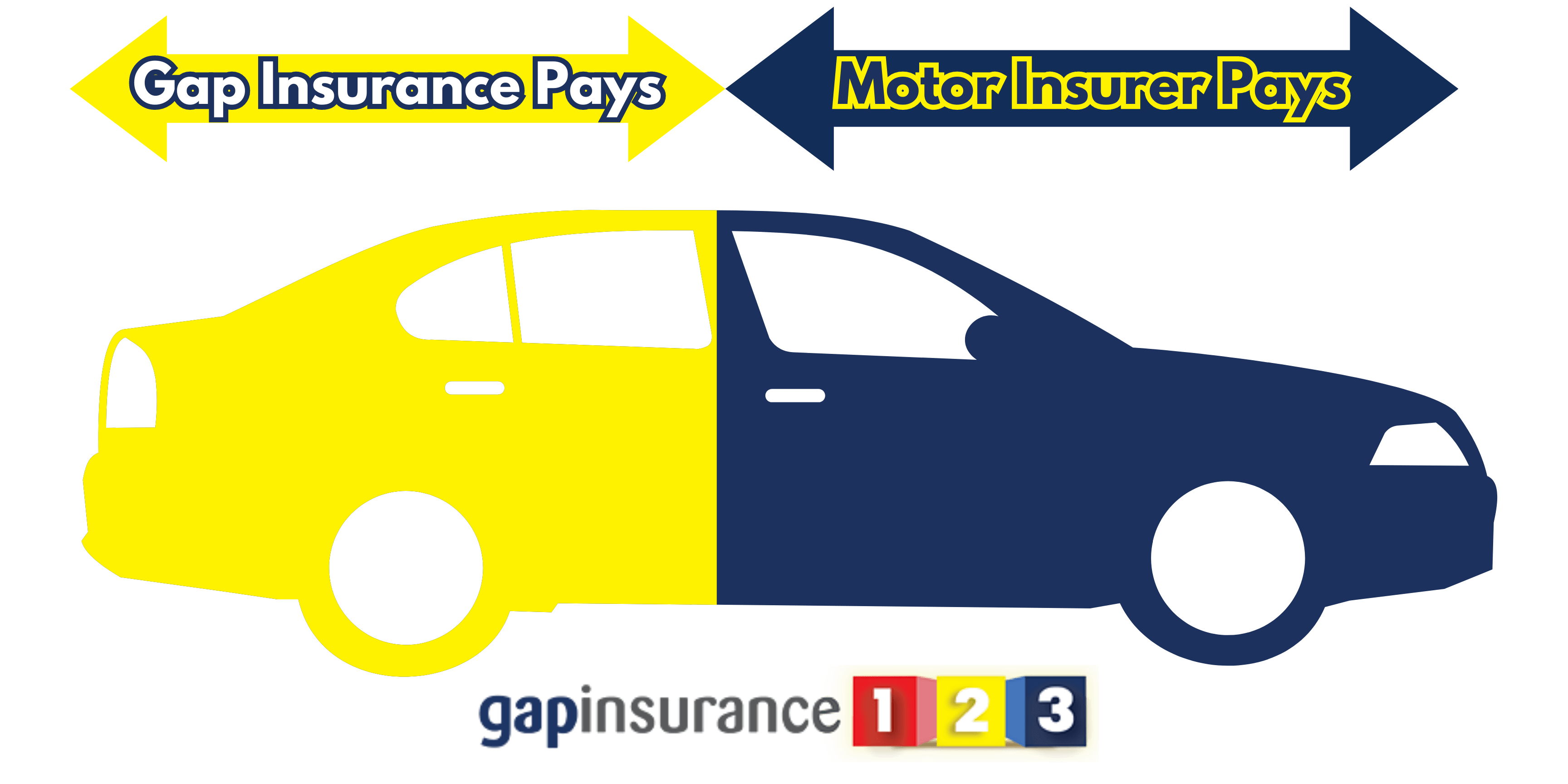

Gap insurance is an optional coverage that protects you from financial losses if your car is written off or stolen.

When you claim, your primary insurance may only pay out the current market value.

This may not cover the outstanding amount on your finance agreement or the original purchase price.

Gap insurance comes in different forms. However, it essentially bridges the gap between the motor insurance payout and, depending on the type you choose, either:

Benefits of gap insurance include peace of mind and protection from financial losses if your vehicle is written off or stolen.

This coverage can be particularly valuable for leased or financed vehicles with higher outstanding balances.

Drawbacks of Gap insurance include the additional cost and the fact that it may only be as beneficial for some drivers.

Alloy wheel insurance

Alloy wheel insurance is a specialised insurance that covers the cost of repairing or replacing alloy wheels in the event of accidental damage, such as curb scuffs, scratches, or scrapes.

This coverage is separate from standard comprehensive insurance policies and is usually offered as an add-on.

The benefits of alloy wheel insurance include protection from costly wheel repairs and maintaining the aesthetic appeal of your vehicle, which can help retain its resale value.

In addition, some lease agreements have hand-back charges for cosmetic damage like alloy wheel scuffs.

Drawbacks of alloy wheel insurance include the extra cost and the fact that it may not be necessary for all drivers, particularly those with standard steel wheels or who take extra care to avoid wheel damage.

Tyre Insurance

Tyre insurance is an optional coverage that covers the cost of repairing or replacing tyres in the event of unexpected damage.

These can be punctures, blowouts, or damage caused by road hazards, such as potholes or nails.

This insurance is separate from standard car insurance policies and is typically offered as an add-on.

Benefits of tyre insurance include financial protection from unexpected tyre replacement costs and peace of mind knowing that your tyres are covered in case of damage.

Drawbacks of tyre insurance include the additional cost and the fact that it may only be necessary for some drivers, particularly those who drive less frequently or on well-maintained roads.

Minor cosmetic damage insurance .png)

Minor cosmetic damage insurance, also known as "SMART" (Small to Medium Area Repair Technology) insurance.

This optional coverage covers the cost of repairing minor cosmetic damage to your vehicle bodywork, such as small dents, scratches, or paint chips.

This coverage is separate from standard comprehensive insurance policies and is typically offered as an add-on.

Benefits of minor cosmetic damage insurance include maintaining your vehicle's appearance and preserving its resale value by covering the cost of minor repairs that might otherwise go unaddressed.

Also, some lease agreements will contain financial penalties if the vehicle is handed back at the end of the lease with bodywork damage.

Drawbacks of minor cosmetic damage insurance include the extra cost and the fact that it may not be necessary for all drivers, particularly those less concerned with their vehicle's appearance or who drive older, more affordable cars.

By considering the various additional insurance products available, you can tailor your coverage to your specific needs and preferences, ensuring that you have the appropriate level of protection for your leased or purchased vehicle.

In this article, we've explored the various aspects of leasing and buying a car, highlighting the pros and cons of each option.

Leasing offers benefits such as lower monthly payments, smaller deposits, access to newer models, no long-term commitment, and maintenance and warranty benefits.

However, it comes with drawbacks like limited mileage allowance, potential charges for wear and tear, no vehicle ownership, difficulty terminating the contract early, and possibly higher insurance costs.

On the other hand, buying a car provides the advantages of ownership, no mileage restrictions, the ability to modify or customise the car, potential equity building, and the ease of selling or trading in. Nevertheless, it also entails higher monthly payments, more significant deposits, depreciation in value, maintenance and repair costs, and obsolescence risk.

When deciding between leasing and buying a car, it's crucial to consider your:

-

needs

-

budget

-

driving habits

-

long-term plans

There's no one-size-fits-all answer. Each option presents distinct advantages and disadvantages that may suit different individuals.

Ultimately, the decision to lease or buy a car is a personal one that should be based on careful research and evaluation of your specific circumstances.

By understanding the pros and cons of each option and considering your individual needs, preferences, and financial situation, you can make an informed decision that best suits your lifestyle and helps you enjoy a satisfying driving experience.

Written 25/4/23, written by Mark Griffiths