Call Monday-Friday 9am - 6pm Closed Saturday & Sunday

Please select some policies.

Need Help? Calling from a mobile please call 0151 647 7556

0800 195 4926 / 0151 647 7556Do you have a question? or need help?

Call Monday-Friday 9am - 6pm Closed Saturday & Sunday,

Investing in a car can be an expensive business. It makes sense to protect that investment with GAP Insurance can make perfect sense. But like any insurance, Guaranteed Asset Protection (the full name for 'GAP') has terms, conditions and exclusions.

Here we will provide you with 50 of the most common exclusions, plus some of the lesser-known ones, that you should be aware of.

GAP Insurance Exclusions: What You're Not Covered For

Understanding GAP Insurance cover

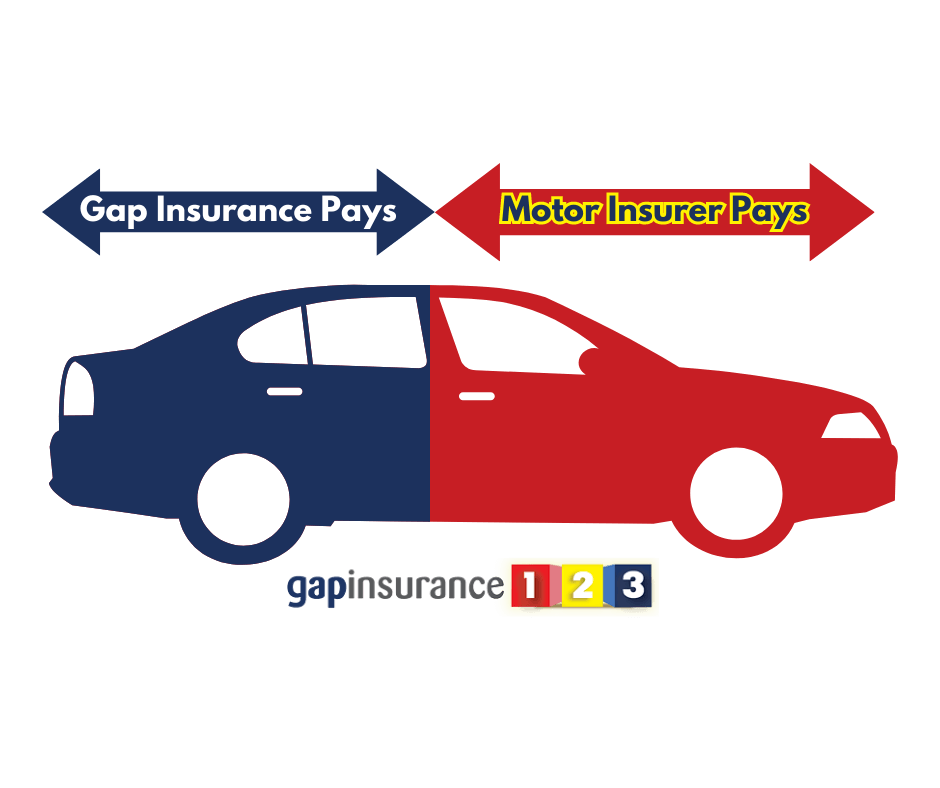

GAP Insurance is an additional layer of financial protection you can use when you acquire a vehicle. It effectively covers a financial shortfall that your fully comprehensive motor insurance does not.

This shortfall is caused by depreciation in the value of the car over time. The GAP Insurance can cover this shortfall if the vehicle is written off or stolen and declared by your car insurance company as such. The motor insurers' settlement is generally for the vehicle's current market value at the point of loss.

This is where GAP Insurance can step in.

We can look at several GAP Insurance types, covering slightly different situations and shortfalls.

The most popular types of GAP Insurance are:

Return to Invoice GAP Insurance - to cover the difference between the motor insurance settlement and the original invoice price paid.

Vehicle Replacement GAP Insurance - pays the difference between your settlement from the main motor insurers' settlement and the cost of the equivalent replacement vehicle.

Finance GAP Insurance - Lease GAP Insurance - to cover the difference between the motor insurers' settlement and the outstanding finance or contract hire agreement.

All insurance products have exclusions. These are factors that may increase the risk of a claim being made. However, insurance needs to be fair also. Underwriters can't just insert exclusions that would mean most people could not make a successful claim on the policy.

By way of an example, it may be unfair for GAP Insurance underwriters to add an exclusion in their GAP policy terms that says anyone who has their vehicle written off following an accident would be excluded from a claim.

The standard motor insurance policy would cover this situation and is a common reason a motor insurer would write off the vehicle. Most people taking out GAP Insurance would expect a vehicle accident to be covered in a GAP claim.

By contrast, if the vehicle was being used for racing or rallying, then this increases the risk of being written off. In this case, most car owners would not be using their vehicle for racing and rallying, which is also unlikely to be covered by the main motor insurance policy.

Therefore, racing and rallying would be a legitimate exclusion on a GAP Insurance policy.

Simply put, no. There will be some exclusions that are common to all GAP Insurance policies. However, there will be differences between products also. For example, most standard GAP Insurance products will exclude use for a taxi or hire and reward use.

However, several specialist GAP products in the market are also designed for taxi/hire and reward use. As these products carry a higher risk due to their use, the GAP Insurance cost may be higher.

You must read the full terms and conditions of the GAP cover you are considering to make sure it protects you in the way you need.

Firstly an important disclaimer. The details below will not be universal exclusions on all GAP policies. Some will be standard exclusions, but some will also be rare. It would be best to decide what you need to be covered for your needs and check that any GAP Insurance policy you are interested in has your requirements.

In no particular order of importance or commonality, here are our Top 50 GAP Insurance exclusions.

Incidents where your vehicle insurance policy does not pay out

GAP Insurance typically requires the vehicle to be covered by a comprehensive insurance policy. Some GAP products, particularly for motorbikes, may offer cover for 'fire and theft' if the policyholder has a third-party fire and theft cover on their main car insurance.

By and large, most GAP products require a policyholder to be fully comprehensively insured.

It may not be covered if the vehicle is used for racing, pace-making, or speed testing.

Vehicles used as taxis (private hire or public hire) or for courier services might be excluded. As detailed above, there are specialist GAP products for these uses in the market.

Any damage or loss resulting from illegal activities is typically not covered. This can include drunk driving, speeding and driving under the influence of drugs. These situations are not likely to be covered by your main motor insurer either.

Some manufacturers, even where the vehicle price falls within general parameters, can be excluded vehicles from cover.

If an accident is not reported promptly, the GAP Insurance may not pay out. Most GAP products will have a time limit within which to put your claim. This may be within a timeframe of the incident or the declaration of a write-off by your car insurance.

Some policies may not cover or have limitations for vehicles that are used or damaged outside the UK. Even where cover is provided, there will generally be restrictions like the countries you can use the car in or the maximum number of days per year you are covered abroad.

Some insurers may exclude vehicles over a specific purchase price or value. Covering up to £50,000 is usually fine. Cars between £50,000 and £75,000 are generally OK, but some may exclude. When you go over £75,000, then choices get typically more challenging.

You may also find a maximum monetary limit to any GAP Insurance claim, even if you can find cover for a higher-value vehicle.

Some policies may exclude vehicles that exceed a specific mileage limit. This maximum mileage is at the time you buy GAP Insurance. Going above this mileage after that time should not cause any further issues in a claim.

Most GAP products have a maximum mileage at a policy start of 80,000. Some allow up to 100,000, and some even 120,000 miles.

The maximum age of the car at the start date of the GAP cover can differ depending on the type of policy you are looking at. For example, Vehicle Replacement GAP (VRI) can be considered more suitable for new or nearly new cars. Some providers may only offer VRI coverage on a new car.

Return to Invoice GAP cover tends to have more flexibility on the vehicle age. For example, GAPInsurance123 currently offers cover for RTI GAP on vehicles up to 10 years old.

Lease GAP Insurance tends to be available for a brand new car only as a leasing deal is typically only available for a new vehicle.

Older vehicles may be excluded from coverage entirely.

Some policies may exclude vehicles used for commercial purposes. These can include delivery vehicles, heavy goods vehicles or refrigerated vehicles. As detailed previously, if standard cover may not provide the required cover, you may be able to find specialist cover in the market.

Vehicles modified from the manufacturer's specifications may not be covered. This is a common exclusion simply because it may be impossible to value the modifications for insurance purposes. Examples of modified cars may be where a specialist repaint has been applied, a body kit or an engine remap.

Damage or loss due to negligence, such as leaving keys in the car, may not be covered. Theft with keys should be OK where the insured vehicle is covered by fully comprehensive car insurance.

This might be where you have locked your car, and someone breaks into your house to steal the keys and the vehicle.

If you leave the keys in the ignition at the petrol station and someone jumps in to steal the car, that would be deemed negligent.

GAP Insurance typically does not cover mechanical failures or breakdowns. If your engine or gearbox blows up, the repair cost is not covered by a GAP policy as it is not a situation where your car insurer would write off the vehicle.

A motor warranty is what you require for such protection.

If your motor insurer writes off the vehicle, they should pay you the market value at that time in the settlement. If they reduce their compensation to you due to the condition of the car, i.e. excessive wear and tear, then this reduction is not generally covered in a GAP Insurance claim.

Any financial penalties imposed for missed payments on a lease or finance agreement are not covered by vehicle GAP Insurance.

The policy may not cover any excess that applies to the motor insurance claim. It should be stressed most GAP products do cover a certain amount of motor excess deduction by your motor insurer, but it is limited.

A standard level of excess cover is £250. Some may cover up to £1000.

If you need a higher excess covered, you may only have a small number of providers available. An alternative would be to take a separate, annual motor excess protection insurance policy.

Where you owe more on a finance settlement than your vehicle is worth, that is called negative equity. GAP Insurance coverage can generally cover this.

However, when the negative equity is added to your finance agreement from a shortfall on your part exchange vehicle, this is usually excluded by standard GAP cover.

You may be able to find a specialist Negative Equity GAP Insurance policy to cover this situation.

Some policies may exclude vehicles used for driving instruction. The standard different types of GAP Insurance products do not generally protect this form of commercial use.

Again, you can find specific GAP protection for driving school use in the UK market.

Many GAP Insurance providers will exclude from cover any imported vehicle. This comes down to the issue of valuing the car. Imported vehicles are not available in Glass' Guide either.

Most GAP policies, like Return to Invoice, Vehicle Replacement or Lease GAP, require acquiring the vehicle from a VAT-registered motor dealer. This means that private buys, eBay buys or vehicles purchased at motor auctions are excluded.

Eligible vehicle sales may be from a main franchised dealer of new and used cars or a second-hand used car specialist.

The option of an Agreed Value or Return to Value style GAP Insurance may be available for private or auction buys.

Glass's Guide is an industry-used valuation service for vehicles. A GAP Insurance provider will want to know the car's value at the point of loss and that the motor insurer is paying their fair share. That can be impossible if the vehicle cannot be valued in Glass's Guide.

It is almost a universal requirement with all GAP products that the vehicle must be listed in Glass's Guide.

Some policies may exclude vehicles that are part of a car-sharing program. Short-term, day rental fleets will also be excluded from GAP coverage. You may be able to find GAP Insurance on a bespoke basis for these purposes.

Cars previously declared a write-off or total loss and then repaired may not be covered. This is because valuing the vehicle is a problem, making it impossible to decide what the main motor insurer and GAP Insurer should pay.

If you buy a new car, some motor insurers provide a new car replacement feature in the first year of cover. If they write off the vehicle in that time, they will give a brand new car as a settlement rather than the market value.

If that offer is in place, many GAP products will exclude a claim where you turn down the option of a replacement vehicle and make a GAP claim instead.

Where the replacement vehicle is taken, the GAP Insurance is usually transferred onto the new car free of charge.

This can include demonstrations, shows, or any form of competition.

If you are VAT registered and can claim back the VAT element of the purchase, then you cannot claim this VAT as part of an eligible GAP Insurance claim.

This can include police cars, ambulances, fire, or vehicles using an emergency blue light. This can include vehicles used for voluntary purposes for emergency purposes.

Farm vehicles or those used for agricultural purposes may be excluded. Again, you may find a specialist or bespoke GAP cover for these types of vehicles.

If you buy GAP Insurance coverage from your motor dealer, this cost can be included on the purchase invoice. The GAP Insurance premium cost is excluded from your claim if the vehicle is declared a total loss.

Different GAP products will have different minimum age requirements for eligible coverage. Usually, the youngest driver covered will be 18 years old. Some have a higher threshold at 21 years old.

Cars used in the motor trade are typically excluded from cover. This is deemed a higher risk. Also, the standard motor insurance is often only for the trade value of the vehicle, not the full market replacement value.

This can include vehicles used for repairs, servicing, or sales within the motor trade.

This can include the replacement cost of personal items in the vehicle, the price of a hire car or loss of earnings for time off work. GAP Insurance is limited to the financial losses linked to the car only.

Some policies may require the vehicle's registration in the policyholder's name. This would be for the likes of Return to Invoice and Vehicle Replacement GAP. The exception would be a Lease and Contract Hire GAP policy where the vehicle is registered to the leasing or finance company.

If you take out a hire purchase or personal contract purchase agreement in your name, the vehicle should also be registered to you. It follows that you should take the GAP Insurance in your name also.

This is because you have an insurable risk for the vehicle. You can own it. The finance settlement is also your responsibility.

If the GAP Insurance policy is in someone else's name, this could invalidate any claim.

It may not be covered if the vehicle is used for a commercial driving school or tuition. Again, specialist GAP products for this purpose are available in the UK marketplace.

The key with any successful GAP Insurance claim is that your main motor insurer has accepted your claim, written off the vehicle as a total loss and paid out the market value to you in a settlement.

If your motor insurer does not cover you or payout and declines your claim, you are excluded from making a claim on your GAP policy.

Perhaps not too much of a shock with this one. Any vehicle driver must hold a valid driving licence in the UK to be covered by the GAP policy.

Any damage or loss resulting from war, invasion, terrorism, or similar activities is typically not covered. This can include civil riots also.

Damage caused by nuclear reactions, radiation, or radioactive contamination may not be covered.

Eligible GAP Insurance cover can be extended to all people, fully comprehensively insured, who is named on your motor insurance policy.

Sometimes we are asked if someone has motor insurance on their own vehicle that allows them to drive another car, would that other person's GAP Insurance cover them? The answer is no because they are typically only third-party insured on your vehicle, so that no write-off settlement will be paid.

If you will let someone else drive your car and want to ensure your GAP policy covers them, add them as a named driver to your comprehensive cover.

These types of vehicles are excluded because they are difficult to value. They would also not be listed in Glass' Guide.

We have often been asked if you can buy GAP Insurance after a vehicle has been in an accident or stolen.

The basis of insurance is to cover a risk that MAY happen, not one that already has.

Therefore, you cannot claim on a GAP Insurance policy you purchased after an incident that may see the vehicle written off has already happened.

Indeed, if you try to do so, you could be committing fraud.

A GAP claim typically requires that if the vehicle has been stolen, you must have reported the theft to the Police and got a crime reference number. .png)

If you make a GAP claim and there is a period left on your Road Tax (Vehicle Excise Duty), you can claim this back from the DVLA online.

If your motor dealer has put a charge for fuel on your purchase invoice, then this is generally excluded from a GAP Insurance claim. This is because you have had the full benefit of the fuel (you have used it!); therefore, it is not a legitimate loss to claim.

GAP Insurance underwriters differ on their view on whether this should be covered or not. Some GAP products do cover the cost of this on a sales invoice; some do not.

If you are getting a paint and upholstery treatment on your new vehicle, find GAP Insurance covering this.

If you have paid for an extended warranty or a service plan, you must check if your GAP Insurance will cover this. GAP policies often exclude these items from a claim as they can usually be cancelled and a refund claimed.

If you have not kept up to date on your finance agreement with a car finance company or missed payments on your lease, your GAP policy will not cover these payments. GAP Insurance covers shortfalls on a lease or finance agreement but not on missed payments.

Ladies and Gentlemen, you may detect we have reached the end of the line. Natural disasters are usually excluded in a GAP claim, but the chances of you being caught out by an earthquake in the UK are slim.

However, you might like to know that damage caused by volcanic eruptions or lava flow may not be covered.

Updated 24/6/23, written by Mark Griffiths

Get a GAP Insurance Quote in minutes.

See all our GAP Insurance Guides.